Brief history of Emporiki Bank

Since the 1950s and for quite some time, Emporiki Bank (Commercial Bank of Greece) was the 2nd largest bank in Greece. Starting in 1957, and within a matter of a few years, the Bank’s group of undertakings grew strong in the context of what Greek economy was at the time. The 1917 Emporiki Bank logo depicts a scene involving the Ancient Greek gods Hermes and Tyche (luck and fortune).

The Emporiki Bank logo is a detail from a 1917 cheque stub.

It depicts a scene involving the Greek gods Hermes and Tyche, the personification of luck and fortune. Hermes (Mercury in Latin mythology), the herald of the gods, wears a winged helmet. In one hand, he holds a staff decorated with 2 wings. The 2 snakes entwining around the staff are a symbol of healing and peace. In his other hand, Hermes holds a money purse.

The goddess Tyche is depicted holding a cornucopia bursting with fruits. This symbol establishes the goddess as a giver of wealth. The ship helm in her other hand is a symbol of her power to direct the lives of mortals.

A winged Hermes, on his own or accompanied by the goddess Tyche, continued to be part of the Emporiki Bank logo until 1958.

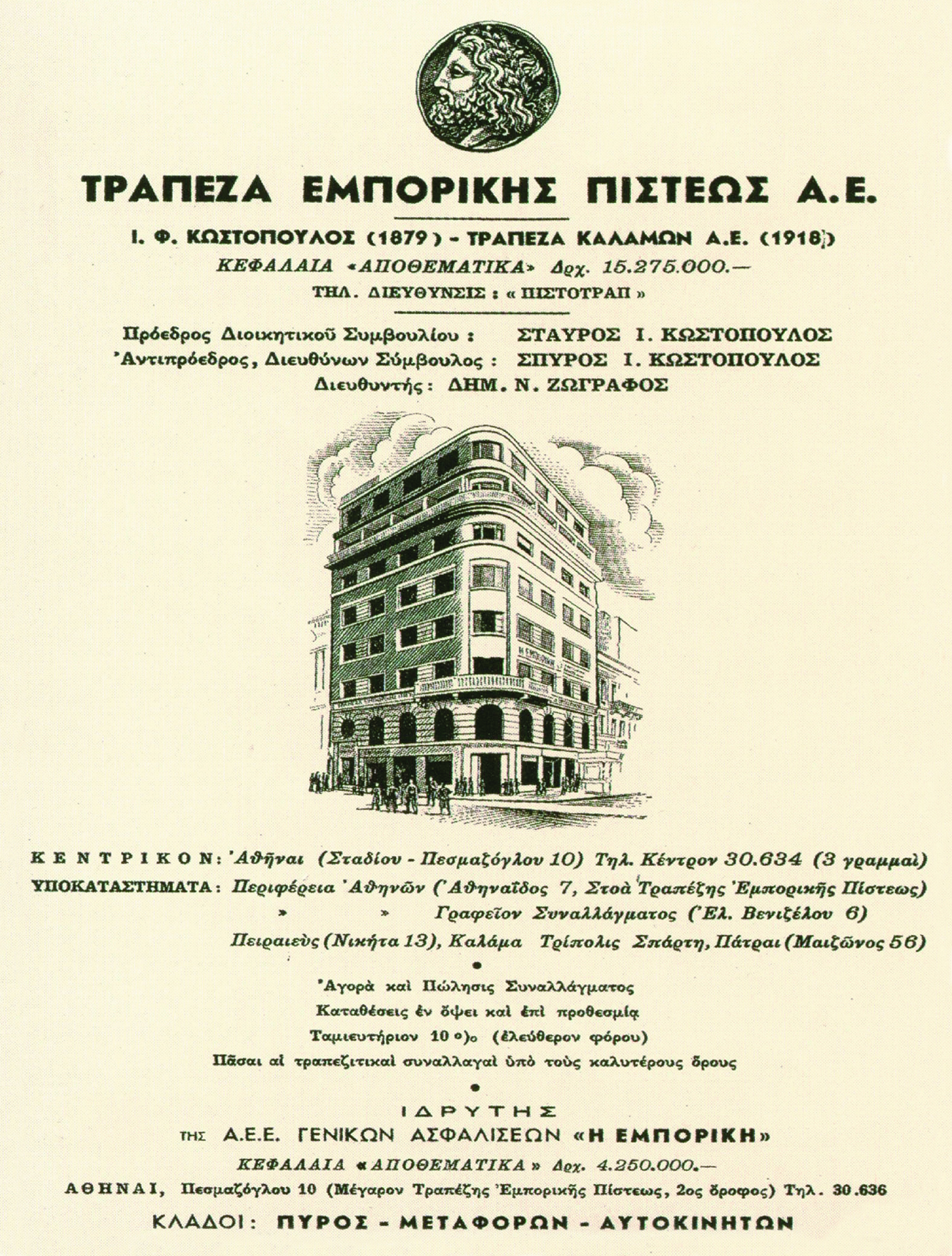

In 1886 a young man called Grigorios Empedocles rented a shop next to the Athens Stock Exchange to house his brokerage and trading agency. Born in London in 1861, Empedocles had settled in Greece in 1875.

Having graduated from the University of Athens Law School and worked as an accountant with the Industrial Credit Bank of Greece, he decided to break into the Greek market with his very own business venture.

In 1892 Grigorios Empedocles turned his agency into a small bank called “Empedocles Bank”.

The establishment of Emporiki Bank

In 1907 Grigorios Empedocles established Emporiki Bank (Commercial Bank of Greece) as the next step after Empedocles Bank. There, he held the position of General Manager.

Long after its foundation, Emporiki Bank still operated on the principles of a family-owned business. Its banking activities were complemented with commercial activities.

The first signs of distress

Despite the sudden breakout of the Balkan Wars, Emporiki Bank managed to adapt its operations to the need for large cash reserves at all times.

However, World War I caused a significant difficulty for the bank. Specifically, the bank could no longer communicate with credit institutions abroad.

A royal decree was then issued that suspended the banks’ obligation to pay checking deposits in cash. Emporiki Bank offered to return the depositors’ funds in securities from its portfolio, which then included a considerable number of Greek debt securities.

Established in Greece with an international outlook

During the Interwar period, the bank established its place in the Greek market. This included creating a sizeable network. By 1938 there were 52 Emporiki Bank branches.

In 1922, following an initiative by Grigorios Empedocles, Commercial Bank of the Near East was founded in London. The newly-established institution initially had branches in Istanbul and, later on, also in Alexandria, Egypt. At the same time, Emporiki Bank ventured beyond the Greek market.

Strain under the Axis Occupation

When war broke out between Italy and Greece, one-third of the Bank’s employees were drafted to fight.

Emporiki Bank loyally stood by its people during the hardship of the Occupation. Relief measures taken included breadlines, loans and emergency benefits.

At the same time, though, the Bank faced turbulence due to changes in administration. The reason for this was founder Grigorios Empedocles leaving the country in 1941.

As of 1943, the Greek economy had started to slump dramatically. Emporiki Bank was confronted with severe liquidity issues and had to resort to selling debt securities and undertakings.

Post-war development

In the first years after WWII, the Bank’s ownership status changed. Shipowner Stratis Andreadis became the controlling shareholder.

In the period that followed, Emporiki Bank significantly expanded its operations and participated in the construction of major public works.

Soon, its group of undertakings grew strong in the context of what the Greek economy was at the time.

The group was not limited to banking and insurance-related undertakings. On the contrary, it spanned the entire secondary industry sector.

Establishing the Emporiki Bank group was also an opportunity to kick off the ongoing modernising reforms. Institutions and practices considered innovative at the time were also adopted.

Under government ownership

In 1975 Emporiki Bank and its entire group of undertakings was acquired by the Greek government.

Over the 1980s, the bank made significant strategic decisions. Those decisions aimed at restructuring the group and streamlining the bank’s operations.

The early 1990s saw a gradual loosening of the restrictions governing the Greek banking system until then. At that stage, Emporiki Bank had already established a new presence within the banking industry. The bank went on to found or acquire new undertakings specialising in modern financial products.

The privatisation of Emporiki Bank

In the summer of 2000, Crédit Agricole SA, the highest-ranking bank in France, acquired 6.7% of Emporiki Bank’s share capital.

In 2006 the same bank submitted a tender offer and raised its stake to 71.97%. In 2011 Crédit Agricole SA acquired all the shares in Emporiki Bank.

In 2012 an agreement was signed to sell Emporiki Bank’s entire share capital to Alpha Bank.

On 28 June 2013, the merger of the 2 banks was completed by absorption of Emporiki Bank by Alpha Bank.

More information on Emporiki Bank is available in our publications:

- With Wisdom and Vision: ALPHA BANK, 19th – 21st Century, academic advisor: Kostas Kostis. The publication narrates the history of Alpha Bank, from founder J. F. Costopoulos’ first commercial ventures in the 19th century through to the present day. It also includes a wealth of unpublished photographic material, mainly from the Alpha Bank Historical Archives.

Buy the publication With Wisdom and Vision: ALPHA BANK, 19th – 21st Century on the Alpha Bank e-shop. - Emporiki Bank 1907-2007: Identity Alternations and Corporate Transformations by Margarita Dritsa. Published to mark 100 years of operation, the book examines aspects of Emporiki Bank’s history.

Buy the publication Emporiki Bank 1907-2007: Identity Alternations and Corporate Transformations on the Alpha Bank e-shop. - Emporiki Bank of Greece: A Chronicle, edited by Vasilis Kremmydas. The publication covers the major milestones in the long history of Emporiki Bank. Only available in Greek.

The Alpha Bank Historical Archives are not open to the public.

Research visits can be organised upon request.

Contact us to request a visit.