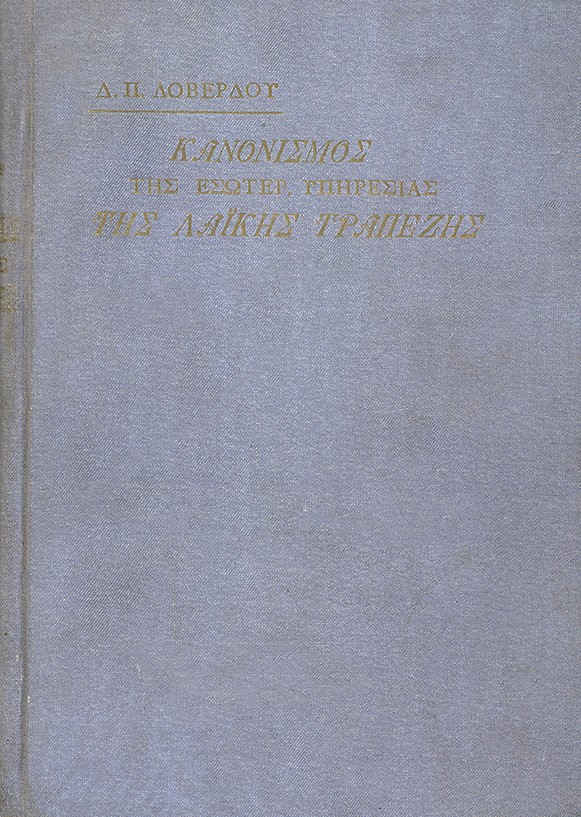

Popular Bank Internal Service Regulation, 1910

The Popular Bank Internal Service Regulation was issued as a standalone publication in 1910. General Manager Dionysios Loverdos had drafted the document 1 year earlier to regulate the operation of Popular Bank’s internal services. Its 5 chapters detailed the services offered to the public at the central branch and the bank’s support initiatives.

Popular Bank Internal Service Regulation, 1910.

At the top left, the name of the author D. P. Loverdos. Below that, the publication title: “POPULAR BANK INTERNAL SERVICE REGULATION”.

Efforts to organise the bank

Popular Bank was established in 1905. Its very existence expressed in the best possible manner the social and economic changes occurring at the time in Athens, the capital of the relatively young Kingdom of Greece.

After the bank was established, founder and General Manager Dionysios Loverdos concentrated his efforts to organise its services in the most effective manner.

Adopting the Regulation

Loverdos drafted the Popular Bank Internal Service Regulation in 1909. The Regulation came into force in the same year.

Its purpose was to regulate the operation of Popular Bank’s internal services.

The bank’s organisational structure was defined by the Central Branch Service, the Piraeus branch and the bank’s pawnbroker service.

The Regulation also detailed the obligations of the employees working in each individual service.

Central Branch Service

Popular Bank’s central branch offered customer service to the public and also ran internal services to support the bank’s operations, allocated to 5 individual sections:

- Accounting Section

- Treasury Section

- Office Section

- Judicial Section

- Auditing Section

Accounting Section

It was the most important section in the bank. It supervised all the deposit and loan operations across the bank’s services.

As far as loans were considered, Popular Bank had launched services no other bank had dared in the Greek Kingdom until then: loans with jewellery, gold, furniture etc. as collateral, prepayment of teachers’ salaries and pension cheques, loans to business companies and assignment of liabilities for government rentals, insured and with collateral.

Treasury Section

This included 5 subsections:

- Cash treasury, overseeing and controlling day-to-day in- and out-payments.

- Notes treasury tasked with submitting notes as collateral or for safekeeping, payment and collection of coupons.

- Treasury responsible for safekeeping pawned objects.

- Securities treasury.

- Agent’s service.

Other sections and services

The Office Section oversaw the registry, correspondence, information, records, employee register, bailiff, concierge, night security guard and cleaning services.

The Regulation also stipulated the establishment of a dedicated pawnbroker service. According to the relevant provisions, the bank would receive any movable asset as collateral, regardless of value. The bearer had the right to take out a loan equal to 1/3 of the item’s value following appraisal.

The independent Judicial and Auditing sections also supported the bank’s operations.

Why the Regulation was published

While doing research to draft the Regulation, Dionysios Loverdos came to the startling realisation that almost no Greek or foreign literature existed on the subject.

Therefore, he saw fit to fill this gap by publishing the bank’s Regulation as a standalone book in 1910. In his own words from the preface: “[This publication] can be taken into account as a template for drafting a bank’s internal service regulation but can also be read as an introduction by those who wish to work in banking.”

The Alpha Bank Historical Archives are not open to the public.

Research visits can be organised upon request.

Contact us to request a visit.